Over 10,000 Tax Returns Reviewed

Tax Planning Strategies That Help Entrepreneurs Build Lasting Wealth— Not Just Savings

Custom Tax Plans. Full Implementation. Audit-Ready Protection.

Built Specifically for High-Income Entrepreneurs and Professionals.

$43.5M

Total Tax Deductions

8 Decades

Combined Experience

$12,680,500

Savings Found in 2024

1,500+

Strategies Availabile

Is This You?

Discover if our specialized tax strategies are the perfect fit for you success

Business Owner, Entrepreneur, or 1099 Contractor

Paying $100,000 or More Each Year in Taxes

Ready for a Smarter, More Aggressive Tax Strategy

If there resonate, you might be missing out on significant tax advantages.

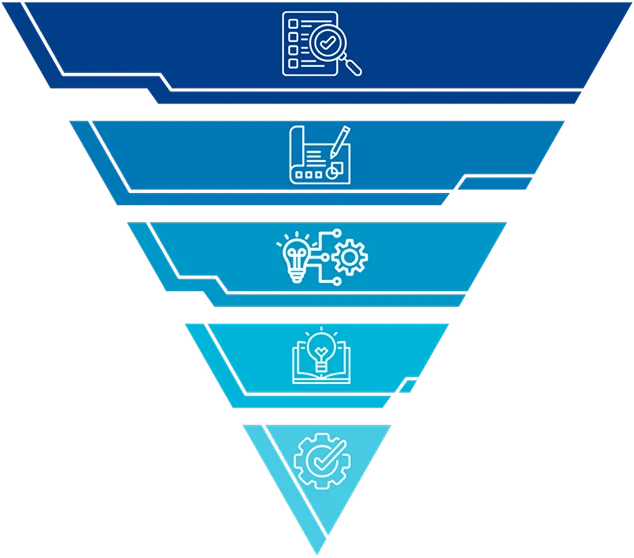

The Prosperity Process™: Strategic Tax Strategy That Builds Wealth, Not Just Savings

Our Proven 5-Step Process to Slash Taxes and Build Lasting Wealth

Most CPAs focus on filing returns. We focus on transforming

your entire financial reality.

Our process is designed to layer strategies, amplify savings,

and protect you for the long haul.

Clarity Audit: Full breakdown of your financial reality— revealing hidden inefficiencies and missed opportunities.

Custom Wealth Tax Blueprint: A personalized tax strategy aligned with your income, goals, and business structure.

Entity Engineering: Legal structure optimization to reduce taxable income and protect assets.

Empowerment Through Education: We teach what’s behind your savings so you’re empowered and in control.

Execution & Oversight: Full implementation, quarterly reviews, and audit-ready documentation.

What Makes Us Different

Real Experts. Real People. Real Results.

Full Financial and Tax Review — Not Just a Quick Look

Multi-Layered Tax Strategy Design Tailored to Business Owners and 1099s

Full Implementation — We Do the Work for You

Quarterly reviews to assess your latest financials and strategically adjust your plan to maximize savings.

Compliance, Documentation, and Audit Protection Built-In

We’re not a once-a-year tax shop or faceless software. Prosperity Tax Advisors is a hands-on team of CPAs, accountants, and wealth advisors who work with you year-round to uncover savings, clean up your books, and build long-term financial strategies. Real experts. Real support. Every step of the way.

80+

Years of combined professional experiecexperience

Our Core Services

Tax Strategy Design

Bigger Savings. Total Compliance.

Client Accounting Services

Stress-Free, Strategic Financial Management.

Fractional CFO Services

Bigger Savings. Total Guided Growth and High-Level Financial Insight..

Who We Serve Best

Entrepreneurs, Business Owners, and 1099 High-Income Earners

Clients Paying $100,000+ Annually in Taxes

Those Seeking Hands-On Strategy, Execution, and Audit Defense

Those Who Want to Keep More and Build Wealth Faster

See What Everyone Is Saying...

Real Client Stories | Images Changed For Privacy

Worth Every Penny – and Then Some

I was hesitant about the investment, but they showed me exactly how it pays for itself. Now I’m seeing real ROI, not just peace of mind.

Julia I.

Consulting

Hands Down the Best Decision for My Construction Business

I always thought I had a solid tax guy—until Prosperity showed me three missed strategies and more than $16,000 in overpayments. We’re now using that savings to reinvest in equipment and hire new crew

Michael F.

Construction

They Speak My Language—No Fluff, Just Results

I’m not a finance guy, and Prosperity never made me feel out of the loop. They explained everything in plain English, showed me the numbers, and delivered. That’s what every business owner needs."

Daniel P.

Real Estate

I Actually Look Forward to Our Quarterly Calls

Our regular check-ins are packed with insights and updates. I always leave with action steps and new ideas to grow smarter.

Jay K.

Wealth Management

A Real Strategy, Not Just Year-End Cleanup

Running a seven-figure furniture business, taxes were always a huge line item. Prosperity stepped in and restructured everything—from C-Corp planning to risk management. They didn’t just save me money—they changed the way I look at growth

Jesse B.

Flooring Company

For the First Time, I Feel Like My Tax Plan Matches My Ambition

I’m a doctor managing a growing practice. Prosperity’s team showed me how to structure charitable giving, risk management, and even personal residence expenses to save over $460,000. It’s not just tax planning—it’s wealth building.

John M

Chiropractor

Worth Every Penny – and Then Some

I was hesitant about the investment, but they showed me exactly how it pays for itself. Now I’m seeing real ROI, not just peace of mind.

Julia I

Consulting

Hands Down the Best Decision for My Construction Business

I always thought I had a solid tax guy—until Prosperity showed me three missed strategies and more than $16,000 in overpayments. We’re now using that savings to reinvest in equipment and hire new crew

Michael F

Construction

They Speak My Language—No Fluff, Just Results

I’m not a finance guy, and Prosperity never made me feel out of the loop. They explained everything in plain English, showed me the numbers, and delivered. That’s what every business owner needs."

Daniel P

Real Estate

I Actually Look Forward to Our Quarterly Calls

Our regular check-ins are packed with insights and updates. I always leave with action steps and new ideas to grow smarter.

Jay k

Wealth Management

A Real Strategy, Not Just Year-End Cleanup

Running a seven-figure furniture business, taxes were always a huge line item. Prosperity stepped in and restructured everything—from C-Corp planning to risk management. They didn’t just save me money—they changed the way I look at growth

Jesse B

Flooring Company

For the First Time, I Feel Like My Tax Plan Matches My Ambition

I’m a doctor managing a growing practice. Prosperity’s team showed me how to structure charitable giving, risk management, and even personal residence expenses to save over $460,000. It’s not just tax planning—it’s wealth building.

John M

Chiropractor

Why Most Firms Fall Short — and We Don’t

The Tax Industry is Broken.

Most firms hand you a cookie-cutter plan and move on — leaving huge opportunities on the table.

At Prosperity Tax Advisors, we go far deeper:

CPAs ensure full compliance and precision.

Our Top Notch Accountants uncover hidden savings opportunities.

Wealth Advisors integrate tax strategies with your overall

financial growth.

Our process

Intro Call (Qualification)

Book a 45-minute Introduction Call to explore your goals, learn how our strategic tax team works, and see if you qualify for our personalized planning approach designed to help business owners build lasting wealth.

Full Tax Assessment

Strategy Development

Custom, strategic plans created by our expert CPAs, accountants, and wealth advisors.